or anyone who manages or owns a business in China, part of the job is to handle Fapiao, which in Mandarin means “invoice”. However, it is not the business/commercial invoice in the general sense, which is merely the documentation of the sales. It is not sufficient in handling tax-related matters. Fapiao is the official tax invoice that is issued by the goods/services provider on each sale to the customer/client.

For individuals, fapiaos are required for claiming business expenses reimbursement from the employer. For the organization, they are the original documentation for recognizing the incurred costs, expenses, revenues in operation, as well as for tax deduction. For tax authority and the government, it is to track transactions for tax purposes and prevent tax evasion.

The State Administration of Tax regulates the printing, distribution, and administration (system named “Golden Tax System”) of fapiaos. The business needs to obtain the blank fapiao paper (with consecutive numbers specially for the company) from the Tax Bureau to issue the official invoice. The fapiao content must be printed onto the blank fapiao sheet with a particular printer that is associated with the tax system. The printing system requires secure login through Golden Tax Device” (金税盘) to verify the company details. The system will automatically generate the correct fapiao number, and the staff is required to place the sheet with the identical number in the printer.

The printer and the Golden Tax Device enable the tax system to identify the company. When a sales transaction is recorded in the system, the corresponding VAT amount is incurred and payable in the following month. The fapiao system and VAT declaration system are connected. When there is a discrepancy between filed monthly VAT declaration and issued fapiaos, the tax declaration system will prevent the declaration process until resolved. Therefore, it is vital to manage physical fapiaos properly. It is advisable to keep them in the company records, which by law is required to maintain 30 years of records

The regulations and restrictions around fapiao are highly localized: the rules on the number of fapiaos can be issued as well as the maximum amount per fapiao could differ by province, city, district, or tax bureau. Even each tax officer might have a different judgment from others. Although it is not the official consideration, the registered capital, office size and number of employees could have an impact on the final outcomes.

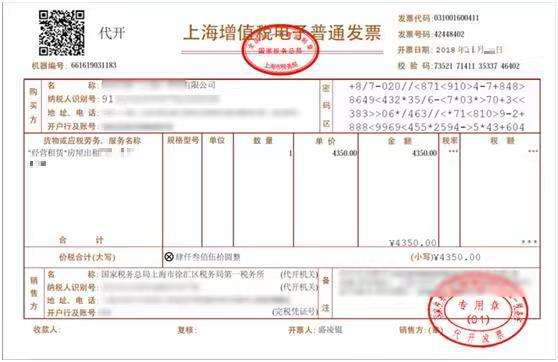

(VAT fapiao sample)

Each fapiao is more than just a single sheet of document. Depending on the type of fapiao, it includes either two or three pieces of paper combined. For the fapiao that allows VAT deduction, it contains 1) Accounting Sheet 2) Deduction Sheet 3) Invoice Sheet. Otherwise, the recipient would not find the deduction sheet.

General VAT vs. Special VAT fapiao

Not all Fapiaos are the same. There are two types of fapiao: General and Special ones. Receiving a Special VAT fapiao entails the right to input VAT deduction while a general VAT fapiao does not. General VAT taxpayers engage in selling goods such as alcohol, cigarettes, clothes, shoes, and cosmetics products are not able to issue Special VAT fapiaos as either.

Small-scale or General VAT Taxpayer?

A business could issue fapiao with either as a small-scale taxpayer or general one.

The VAT rates for the former are typically 3% (currently 1% due to the COVID-19 crisis) but unable to deduct VAT input. Therefore, they can only use General VAT fapiao for all transactions. General taxpayers are subject to 6%, 9% or 13% VAT depending on the sectors the companies engage. For information on what does it mean to be a small-scale/general taxpayer and the criteria, please click here.

A few notes on issuing the fapiao

Timing: As the liability of VAT arises in the current period upon printing, it is advisable to issue fapiao after the payment is received to prevent creating stress on cash flow. Another reason being to cancel a fapiao is a complicated and time-consuming process, especially so if the issuing date and the cancellation date fall into different accounting periods.

Obligation: Fapiao is issued upon the customer’s request, not by default. They are entitled to a fapiao when the ownership of goods is transferred, or the service has been performed. The customer has the right to report the company that refused the duty to issue fapiao to the relevant authority.

Value in having a trusted corporate service team

Managing fapiao is a unique aspect of operating a business in China. It essentially is the official track record of business transactions for accounting and tax purposes. Mishandling fapiao not only would create chaos in accounting and tax figures, but also unnecessary workload for correcting them and even penalty of incorrect records.

Small to medium-sized firms usually require more careful budgeting and cost planning. Having a qualified accountant to manage fapiao would be a waste of human capital. Hiring a dedicated junior staff to manage fapiao entails a higher payload. Therefore, outsourcing fapiao related tasks to a trusted external service team could be the perfect answer. STAR Accounting & Consulting is experienced in providing professional services to foreign enterprises of all sizes with diverse needs. To arrange a chat with our experts, please contact Nancy Chen at Nancy@www.star-acc.com.

You made some clear points there. Rebecca Damon Ot

Thanks-a-mundo for the blog. Really looking forward to read more. Really Cool. Amelia Heindrick Jaymee

Good article! Tera Trey Godliman