One of the paramount criteria on whether a company/business is operating successfully is its profitability. The ability to generate profit is usually the first thing to consider. Although the two terms are often used interchangeably, and they are both accounting metrics in analyzing the financial well-being of the firm, they are distinctively different.

Profit is the total revenue minus total expenses and will appear on a company’s income statement.

Profitability is a relative term instead of an absolute figure, which is the measurement used to determine the scope of a company’s profit in relation to the size of the business. It is a reflection of efficiency essentially and ultimately a verdict of success or failure. While a company can realize a profit, this does not necessarily mean that the company is profitable.

An analysis of the profitability is necessary to comprehend if it is efficiently utilizing its resources and capital. Usually, one of the first things and the most straightforward aspects analysts, and in turn, accounting specialists will assess is the profit margin.

Profitability – Profit Margin

Profit margin, presented as a percentage, indicates how many cents of profit have been generated for each dollar of sale. The different profit margin ratios reflect the profitability on the different levels of cost, among which the Net Profit Margin represents the bottom line of the company after taking out all relevant expenses and costs.

Internally, business owners, company management and external consultants use it for address operational issues, identifying seasonal pattern and corporate performances. Externally, profit margins are used by creditors, investors and business management as parameters on the financial health, management competency and growth potential.

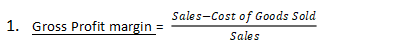

Gross profit margin measures how much a company makes after accounting for Cost of Goods Sold (COGS). It is most useful when performed on a per-product basis, which collectively reflect the profitability of the product suite.

![]()

Operating Profit Margin, also referred to as Return on Sales, is an indicator of how well it is being managed and how efficient it is at generating profits from sales. It offers more details compared to Gross Margin, showing the proportion of revenues that are available to cover non-operating costs (for instance, interest). This is why investors and lenders pay close attention to it.

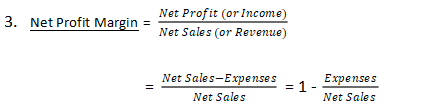

One of the most significant measurements of profitability – a company’s bottom line after all other expenses (including taxes and one-off payments) being removed from revenue. If a firm realized net sales worth RMB100,000 during a particular quarter while spent RMB 80,000 in total on various expense, the profit margin would be 1- = 0.2 or 20%.

The higher percentage, the higher the profitability performance. And the last variation has intuitively indicated that by either reducing expenses or boosting the sales figure will elevate the net margin figure.

Application of Profit Margin

Theoretically, there are a few levers for the management or business owners to achieve higher profit margins: increasing price, increasing the volume of units sold, expense control or the different combinations of the above. Pragmatically speaking, each one of them has the upper limit on the extent of implementation. The price increase could only be to the extent where the competitive edge is not compromised; sales volumes are dependent on the market demand, competitors’ positions, and the market share percentage commanded by the business; reducing the non-profitable product line might entail losing out on corresponding sales.

Therefore, improving the profit margin becomes a fine balancing act among adjusting price, volume and cost controls. It functions as an indicator of the business owner’s or management’s adeptness in executing pricing strategies that result in higher sales, and efficient cost control.

Comparing Profit Margins

The caveat of profit margin is when it is used in a comparative analysis for each business has its own distinct operation and profit generating strategy. And the ability to generate high revenue does not necessarily translate to profitability.

Generally, the business with lower profit margins (such as retail, nail salons, transportations…) have high turnaround which enabled high profits despite the low profit margin figure. For instance, Microsoft and Alphabet generate high double-digit quarterly profit margins while Walmart and Target achieved single-digit ones. It is not to be concluded the latter two were less successful business compared to the formers. Profit margin analysis need to be performed with care when compared across different businesses and industries. And the sheer figure of the cashflow involved in each deal, the volume of the transactions, the industry size should not be taken as the synonyms for profitability. A nail salon might just be as profitable as a mid-tier accounting firm – after all, there must be some reasons for them to be EVERYWHERE! 😉

STAR (Shanghai) Accounting and Consulting Co Ltd – A Member of IECnet – International Association Of Accountants, Auditors And Tax Consultants –

Unsure about something? STAR is always here to help.

Have a chat with us today!

Pay us a visit to: www.star-acc.com