The battle with COVID-19 pandemic has been on-going for nearly a year. With the victory date not in the horizon and the global economy operating on its half capacity at best, many business owners/investors are seeking opportunities to keep things floating. China has managed the crisis promptly and effectively, which paid off in its economy. Intuitively, foreign investors are landing their eyes on the Chinese market. Though many of them are not sure where to start, and what is the best business model.

In this short case study, we are going to use an example in retail to shed some lights on this subject.

CASE STUDY

ABC group is an international apparel company with HQ in Sweden. It owns a ready-to-wear women clothing brand “XYZ” intending to explore the Chinese market. The followings are the potential business model options in setting up operations in China:

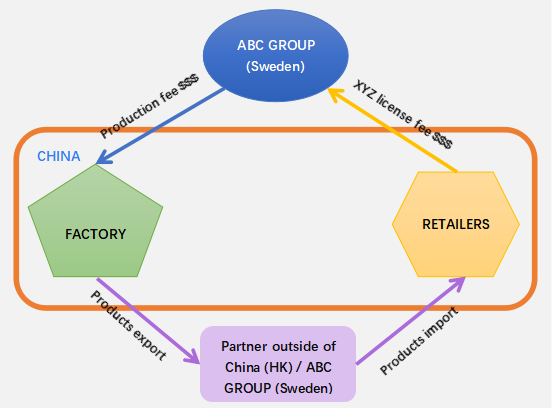

Scenario I Operating directly with Chinese factory and retailer from Sweden

ABC group could partner up with local factories to manufacture their products and local retailers to distribute the products.

First of all, one of the significant downsides of this arrangement is that, if the ABC group operate directly with Chinese factories and retailers, the products manufactured would have to be exported. Otherwise, the factory will not be able to justify to the authority the legitimacy of the revenue received from the ABC group. If the products were meant to be distributed in China, subsequent importation will occur, which entails custom duty and value-added tax. The destination of products exportation does not have to be where ABC group is located – as long as it is outside of the mainland border. Therefore, HK could be a potential option.

The extra custom duty and tax liabilities occurred under this arrangement will most likely wipe out economic incentives in expanding the China market. Additionally, the license fee paid to ABC by local retailers individually will require proper justification to the authority, and the procedures of remitting funds to foreign entities often need previous experiences. There is a good chance that some retailers have none. And neither do they have the motivation to learn the procedure for just one deal.

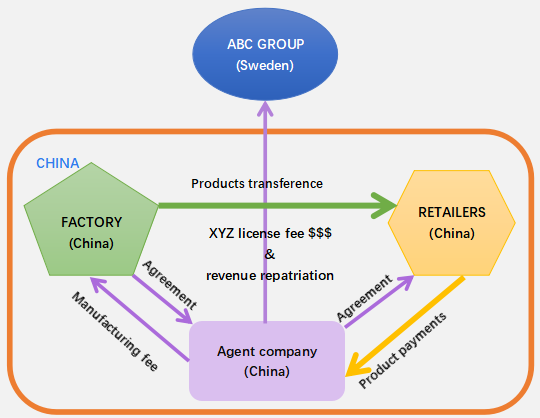

Scenario II Appointing a local agent firm

The second arrangement can be having a local company acting as the agent on behalf of ABC Group for the contract signing, issuing documentation for product logistics, and license fee repatriation.

The possible issue in this scenario is that, from the standpoint of the local agent, it could create legal risk for itself for a meagre reward. In the case of any injuries of consumers (e.g. death caused by a hidden needle inside of the shirt collar) resulted from a faulty XYZ product, the consumer will take the legal action towards the retailer. Consequently, the retailer will hold the local agent accountable as the product was sold to them by the local agent. The financial penalty resulted from the faulty product case will fall on the agent until reimbursed by the factory, even though the factory was responsible. It would create an enormous amount of unnecessary responsibility and inconvenience. And the agency fee is usually just 1 to 2% of the sales revenue – anything higher would not be economical for the ABC group. Moreover, again, whether or not the local partnered firm has experience in remitting funds overseas is uncertain. Therefore, it will be rather difficult to form such an agreement with a local company as the reward is not nearly enough for the responsibility it will ensure.

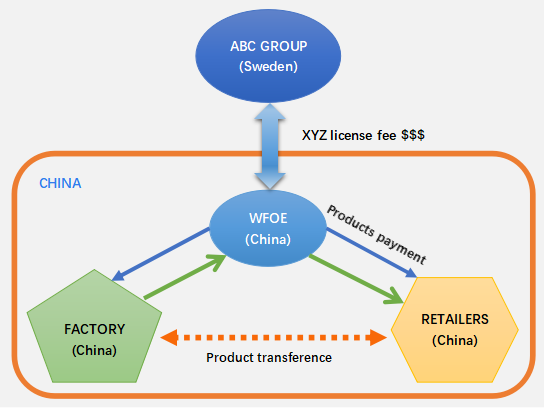

Scenario III Operating through a WFOE in China

The third alternative is that ABC group establish a WFOE under its name, having it dealing with the factories and retailers as well as be fully legally responsible for the product quality. The burden of XYZ’s license fee will consequently fall on the WFOE in China.

The drawback of this option is mainly cost related – the initial cost and time in registering a WFOE, as well as the operational cost regarding accounting and administration. There are specific compliance regulations all entities in China are required to follow, for instance, the regular tax declaration (read this article for detailed info on compliance regulations). Apart from the initial investment, this option is ideal as it eliminates all the issues that will occur in the previous scenarios.

The WFOE has the complete autonomy over the entire operation in China, without having another entity getting involved and sharing the risk, neither does it need to rely on retailers to settle the license fee. It will form an agreement with the factory and retailers separately, with all relevant payment billed in RMB. The product ownership will directly be transferred to WFOE from the factory when the products are ready, subsequently to the retailers. The WFOE will organize the logistic of product transference, and products will be transported from the factory directly to the retailers. The license fee of XYZ brand will be settled by WFOE in one transaction back to the headquarter ABC group.

Whilst the rest of the globe are still battling their way out of the crisis, the economy in China appear steady. With the travelling restrictions among countries, foreign business owners/investors are putting their Chinese business plan on hold indefinitely, while it does not have to be. The process of establishing a business in China could be entirely offshore – entity registration, opening bank account, subsequent accounting & taxation, as well as organizing trading documentation. And there has never been better timing to get business partners on board with virtual communication.

Established in 2007, STAR has assisted 300+ clients from five continents with market entry, provide a one-stop solution to your China business vision: incorporation, accounting outsourcing, tax advisory and HR service. Moreover, the Virtual CFO service enables foreign investors to establish an entity, to monitor and manage financials remotely, to properly document the usage of all chops/stamps and track their whereabouts, from outside of China. For more information regarding WFOE registration, Virtual CFO or business consultation, please contact Nancy Chen on nancy@www.star-acc.com.